The study, at its first edition, aims to understand better the global market for horticultural lighting, its competitive landscape, and the new opportunities arising from the growth of the agritech business.

Horticultural lighting is a technology that stimulates photosynthesis in plants by emitting suitable wavelengths, and it is one of the fastest-growing markets in the lighting industry.

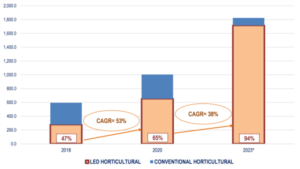

The report provides estimates 2018-2020 and forecasts 2021-2023 of total and LED-based consumption of horticultural lighting fixtures at the global level and broken down by geographical area. Between 2018 and 2020, the horticultural business kept increasing at a CAGR of 30%. CSIL estimates that the sector will reach US$ 1.8 billion by 2023. Asia-Pacific is the largest regional market, followed by North America and Europe.

In the study, the demand is broken down by light source (conventional and LED) and by application (greenhouses, indoor and vertical farming, and others including R&D, animal barns, and aquaculture). The technological evolution of the horticultural lighting industry is provided by analysing Intellectual Property (IP) applications.

The competitive system analyses the main companies active in the horticultural lighting fixtures market are reported with data on sales, market shares, and short company profiles. The market is quite concentrated among the largest players; the top 10 largest players from the CSIL sample hold a cumulative market share of over 50%. Signify is by far the leading player with a market share of 14%, followed by Fluence by Osram and Gavita.

The report is completed with an analysis of the main market drivers (food demand and population dynamics, climate change and weather uncertainty, and cannabis legislation evolution) together with the other players operating in the agritech industry.