The European lighting fixtures market declined in 2023, following two years of exceptional growth. The total market value fell by 12% to approximately EUR 17 billion. However, despite this contraction, the market remains 6% larger than in 2018.

Market performance has varied across segments in recent years. During the pandemic, residential lighting saw stronger demand, but this trend has since reversed, with professional lighting recovering more robustly. Outdoor lighting has outperformed the market average, with steady annual growth of 1.5% since 2018. Several structural factors continue to shape the sector, including the European Union’s ban on fluorescent lamps, rising electricity costs, and the increasing adoption of smart lighting solutions. LED lighting now accounts for nearly 90% of the total market.

Looking ahead, the market is expected to remain challenging in 2024. Investment in residential construction across Europe is projected to decline by over 5%, though a modest recovery is anticipated in the following years.

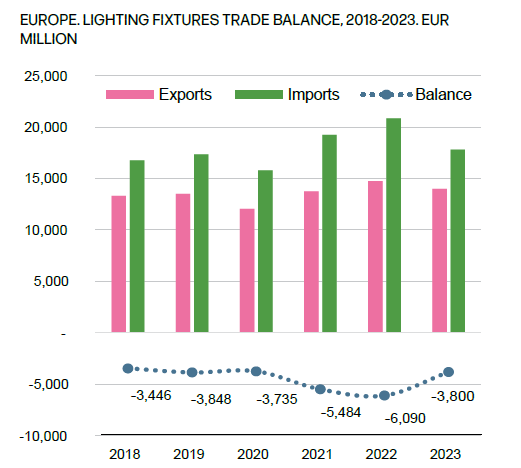

The European lighting fixtures trade saw a decline in 2023, with exports falling by 5% to EUR 14 billion and imports dropping by 15% to EUR 18 billion. This sharper decline in imports contributed to an improved trade balance, reducing the deficit from EUR 6.1 billion in 2022 to EUR 3.8 billion in 2023.

Germany remains Europe’s largest lighting fixture exporter, accounting for 19% of total exports, followed by Italy, the Netherlands, Poland, and Austria. Around 80% of exports remain within Europe, with North America serving as the most significant overseas market, followed by Asia-Pacific and the Middle East. Italy holds the largest net trade surplus in the sector, amounting to EUR 900 million.

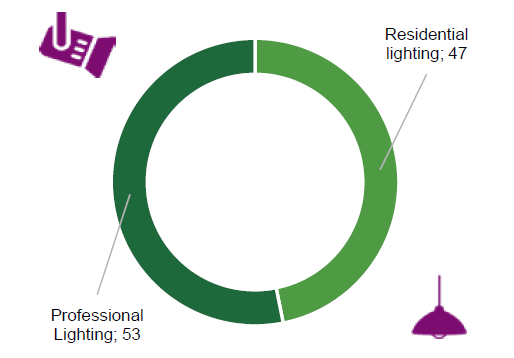

On the import side, the leading European markets for lighting fixtures are Germany, France, the United Kingdom, the Netherlands, and Italy. In 2023, over 45% of European lighting fixture imports originated from the Asia-Pacific region, with China alone accounting for 43% of total imports. However, imports from Asia-Pacific saw a significant decline of 25.5% compared to the previous year. Professional lighting fixtures accounted for 53% of imports, while residential lighting fixtures made up the remaining 47%.

Technological advancements continue to reshape the lighting industry, with smart and connected lighting playing an increasingly prominent role. The market for connected lighting in Europe has expanded significantly, now accounting for 19% of the total market—double its share in 2019.

At present, connected lighting is more widely adopted in commercial, industrial, and outdoor applications than in residential settings. However, as smart lighting solutions become more user-friendly, adoption within the home lighting segment is expected to grow. These innovations not only enhance convenience but also contribute to significant energy savings through features such as programmable lighting systems, occupancy sensors, daylight harvesting, and integration with heating, ventilation, and air conditioning (HVAC) systems.

Several major mergers and acquisitions took place in the European lighting industry in 2024, reflecting ongoing consolidation and technological integration:

These acquisitions highlight the sector’s evolving competitive landscape, with companies expanding their capabilities in connectivity, energy efficiency, and niche applications.

Despite short-term economic challenges, the long-term outlook for the European lighting market remains positive. The industry is set to benefit from increasing demand for energy-efficient and connected lighting solutions driven by regulatory requirements, sustainability concerns, and technological advancements. While 2024 may be a year of adjustment, CSIL forecasts indicate a return to growth in 2025 and 2026.

Read more on CSIL Report The European market for lighting fixtures, a detailed analysis of the lighting fixtures industry for 30 countries.